Layer 1 vs Layer 2 Blockchain: Understanding the Backbone and the Boost

The Foundation and the Fix: Why Blockchain Layers Exist

For anyone new to crypto or decentralized technology, the terms Layer 1 vs Layer 2 blockchain may sound overly technical. But these concepts are at the core of how blockchain systems evolve to meet user demand without losing their key strengths: decentralization, security, and transparency.

Layer 1 blockchains act as the foundational infrastructure. They handle the basic operations: validating transactions, maintaining consensus, and recording everything on a public ledger. Layer 2, on the other hand, is a response to growing pains. It’s built to make things faster and cheaper without rewriting the foundation from scratch.

Let’s break down both layers clearly and see how they work hand-in-hand in the blockchain world.

A Quick Recap: What Is a Blockchain?

Credit from Investopedia

A blockchain is a shared, tamper-resistant digital ledger. Unlike traditional databases stored in central servers, blockchains are decentralized. Each participant (or node) keeps a copy of the entire ledger. New transactions are validated through consensus mechanisms and grouped into blocks that are chronologically chained together.

This decentralized structure makes blockchain useful for peer-to-peer transfers, digital ownership, and trustless systems. But as more users join the network, scalability becomes a problem—and that’s where layering comes in.

Understanding Blockchain Layers in Context

Blockchain architecture has evolved into distinct layers, each addressing different technical functions. Here’s a simplified view:

- Layer 0: The communication infrastructure beneath blockchains. Examples include Cosmos and Polkadot.

- Layer 1: The base protocol where blocks are created and consensus happens.

- Layer 2: Extensions to Layer 1 that improve transaction speed and reduce fees.

- Layer 3: User-facing applications like wallets and DeFi platforms.

We’ll focus on Layer 1 and Layer 2—the two layers that directly influence blockchain usability and performance.

Layer 1: The Main Chain

Credit from TradeDog

Layer 1 is the core blockchain protocol. All the essential activities happen here: validating blocks, processing transactions, and maintaining the security of the system. Think of it as the operating system of a blockchain network.

Core Characteristics of Layer 1:

- Native execution of smart contracts (on platforms like Ethereum).

- Full decentralization through consensus algorithms like Proof of Work (PoW) or Proof of Stake (PoS).

- Permanent on-chain data storage.

Real-World Examples:

- Bitcoin: Focused on secure and verifiable digital currency transfers.

- Ethereum: The most popular smart contract platform, though historically challenged by high gas fees.

- Solana: Built for speed, it processes thousands of transactions per second, but with trade-offs in decentralization.

- Cardano: Emphasizes academic research and a layered architecture.

Scalability Limitations:

The downside of Layer 1 is its performance bottleneck. As the network becomes busy, it can only handle so many transactions at a time. Ethereum, for instance, still processes fewer than 30 transactions per second on Layer 1. During congested periods, this leads to longer wait times and higher gas fees.

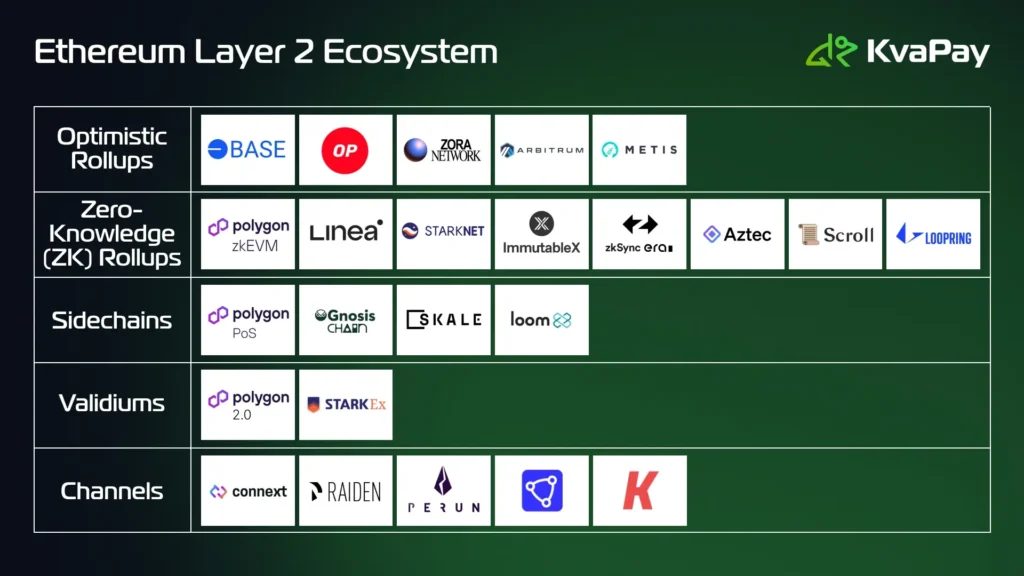

Layer 2: Building Speed on Top of Trust

Credit from KvaPay

While Layer 1 handles the groundwork, Layer 2 blockchains are designed to scale that system. They don’t replace the base chain but complement it. Most Layer 2 solutions take computation and transaction processing off-chain and submit only summary data back to Layer 1.

This significantly reduces both cost and time, while still preserving the trust and security of the original chain.

How Layer 2 Works:

- Users interact with Layer 2 networks where operations are executed rapidly.

- Finalized data or proofs are then passed to Layer 1, ensuring security.

- Since only minimal data is submitted back, Layer 1 remains less congested.

Prominent Layer 2 Technologies:

- Lightning Network (for Bitcoin): A network of payment channels that allows instant BTC transfers.

- Arbitrum and Optimism (for Ethereum): Rollup solutions that bundle thousands of transactions and settle them as one on Ethereum.

- zkSync: Uses zero-knowledge cryptography to verify off-chain transactions efficiently.

Benefits:

- Transaction costs drop sharply.

- Transaction throughput increases significantly.

- End-user experience improves, especially for decentralized applications.

By offloading the workload, Layer 2 enables broader adoption of blockchains in areas like gaming, DeFi, and retail payments.

Table: Comparing Layer 1 vs Layer 2 Blockchain

| Layer | Primary Function | Transaction Speed | Typical Fees | Example Use Cases | Examples |

|---|---|---|---|---|---|

| Layer 1 | Base protocol and consensus engine | 7–65 TPS (varies by chain) | Often high during demand | Smart contracts, secure ledgers | Bitcoin, Ethereum, Cardano, Solana |

| Layer 2 | Scaling through off-chain processing | 1,000+ TPS (aggregated) | Low to near-zero | Microtransactions, games, scalable dApps | Lightning, Arbitrum, Optimism, zkSync |

Layer 1 vs Layer 2 Blockchain: Why Not Just Upgrade Layer 1?

A common question is why we don’t just upgrade Layer 1 to be faster. The answer lies in trade-offs.

The blockchain trilemma suggests that it’s hard to achieve decentralization, security, and scalability all at once. Improving one may weaken another.

Layer 1 chains prioritize security and decentralization, which can limit scalability. By building Layer 2 protocols, developers can enhance scalability without compromising the trust and reliability of the base network.

Moreover, changes to Layer 1 are risky and complex—they often require consensus among thousands of nodes, may involve hard forks, and could disrupt existing applications.

Layer 1 vs Layer 2 Blockchain: Real-World Applications of Layer 2

The Layer 2 ecosystem is rapidly growing. Ethereum’s rollups now handle more transactions than its base layer. According to L2Beat (as of mid-2025), over $18 billion in value is locked across Layer 2 protocols.

- DeFi platforms like Uniswap v3 and dYdX have moved parts of their operations to Arbitrum or zkSync.

- Gaming chains use Layer 2 to offer real-time in-game asset trading.

- Retail crypto payments—especially in developing countries—are increasingly reliant on networks like the Lightning Network for Bitcoin.

These cases demonstrate how Layer 2 is not a theoretical concept but a working solution already adopted across industries.

The Road Ahead of Layer 1 vs Layer 2 Blockchain

Looking forward, we’ll likely see an increasingly modular blockchain design. Ethereum is already transitioning toward a “rollup-centric roadmap”, meaning that most of its activity will eventually be handled by Layer 2 rollups while Layer 1 focuses on settlement and consensus.

New chains are also launching with Layer 2 compatibility in mind from the start, reducing the need for retrofitted scaling solutions. Meanwhile, developers are building bridges between Layer 2 networks, enabling greater composability and efficiency.

Final Thoughts: Why Understanding Layer 1 vs Layer 2 Blockchain Matters

Grasping the difference between Layer 1 and Layer 2 blockchain systems gives you more than just technical insight—it helps you understand the direction blockchain is heading.

Layer 1 provides the trust foundation. Without it, there’s no reliable ledger. Layer 2 offers the performance enhancements that allow these systems to work in real life, for real people, on real platforms.

If decentralization is to scale to billions of users, Layer 2 will be a critical part of that journey. Whether you’re investing, developing, or learning, knowing how these layers interact prepares you for a blockchain future that’s fast, flexible, and secure.